Net Better Nut Butter

I could live on peanut butter1. I eat a lot of it. But… could it be better?

tl;dr: yes, just mix in 1.5 tsp flax oil per 100g PB.

fats

I did a little research about fats recently, and by “a little research”, I mean “talked with a friend who’s a doctor, and Clauded a bit”, coming to the following conclusions:

- Fat can be saturated, polyunsaturated, monounsaturated, or trans. Polyunsaturated includes omega-3 and omega-6 (and a few others like CLA).

- Saturated fat: Bad, Actually2

- Polyunsaturated fat: a mixed bag. In theory, omega-3 and omega-6 are both good, and ideally you’d get a ratio of 4:1 omega-6 to omega-3. In practice, everything has a lot of omega 6 and nothing has much omega-3 so “get more omega-3” is usually in the right direction.3

- Monounsaturated fat: generally pretty good?

- Trans fat: just the fuckin' worst, everyone agrees. Luckily, they’re not really in nut butter, so I’m leaving them out of this discussion.

Based on this, peanut butter feels not terribly great to eat a ton of. In 100g of peanuts you get ~49g of fat, including 7g saturated, 10g omega-6, 0g omega-3, and 26g monounsaturated.4 Can we increase the omega-3 and/or decrease the saturated? (Also, can it taste even better?)

let’s make nut butter

For the omega-3, I found that almost nothing nutty has omega-3. Exceptions include walnuts (4:1 omega-6 to 3 ratio), hemp seeds (3:1), flax seeds (1:3!) and chia seeds (also 1:3!)

For saturated fat, I wanted to look into almonds and walnuts too: about half as much saturated fat as peanuts.

For taste: let’s just try them all!

So I bought a bunch of nuts and ground them up. Here are some things I found:

- The blender actually grinds better than the food processor5. It’s harder to clean, though.

- Peanuts are among the best tasting nuts. Cashews and pistachios are good too. Almonds make the whole thing taste kinda dry/woody, and walnuts taste bitter.

- So if walnuts are out, then flax seeds are our only source left of omega-3. But ground flax seeds make the whole nut butter kind of gummy. Better off just using flax oil.

- Flax tastes kinda bitter. I wonder if omega-3 fats just taste bitter. Bummer if so. At any rate, you can usually hide up to about 1.5 tsp per 100g of nuts; above that, you start tasting the bitterness more.

- Luckily, though, that’s a good amount of omega-3! 100g peanuts + 1.5 tsp flax oil gets you to an omega 6-3 ratio of 2.4, which is plenty low enough.

- I didn’t get much taste benefit from mixing nuts. There may be a delicious brew out there. I didn’t find it.

So:

The Best

that I’ve found is just 100g peanuts, 100g cashews, and 3t flax oil.

Upsides: almost 4 grams of omega-3 per 100g. If you had 2 Tbsp (30g) of this, that gets you 1.2g omega-3, almost the RDA. The omega 6-3 ratio is 2.4, so (assuming the rest of your diet is more than 4:1) you’re moving in the right direction. Tastes very good; you almost don’t notice the flax.

Downsides: doesn’t help with the saturated fat; about 8.5g per 100g, 1g more than regular peanut butter. Cost is not awesome at $7.80/lb.

the second-best

well look, you can improve on both of those downsides by just making peanut butter + flax oil. 100g peanuts + 1 tsp flax oil is super cheap and high omega-3. Hell, just mix in flax oil to premade PB. But I can’t write a whole blog post and have that be the punchline.

future work

- chia seeds. They’re weird little guys. I tried to grind them once but had more luck just making chia pudding. Chia pudding’s good though, and pretty easy.

- hemp seeds. At 3:1, they don’t really pull the omega 6-3 ratio down too much, but they seem to be more neutral tasting than flax.

- pumpkin seeds, sunflower seeds, pecans, and macademia nuts. All widely available and potentially tasty.

- toasting vs not: I tried this with walnuts, to not much effect taste-wise. I don’t know about the effect on the fats. I would imagine that the omega-3s might stick around more in a less-cooked form, but I’m just guessing

- is this omega-3 even good enough? Something about how ALA (the omega-3 in flax) is not as important as DHA/EPA (the omega-3s in fish) so maybe this is all a red herring. And maybe I should just eat more red herring.

spreadsheet

Here! Have at it. If you come up with a better nut butter, let me know!

I think I first noticed this when studying abroad in The Netherlands. Peanut butter seems to be a very US centric food. Supposedly NL is the best place in Europe for PB, but even there, I had a hard time finding enough of it reliably. Which leads me to think: the rest of the world must be an absolute PB wasteland! (shudder) ↩︎

I guess this is the common wisdom. But in the past couple decades of paleo, keto, anti-seed-oil, etc, I feel like I’ve read a lot of stuff arguing that saturated fats, like in butter and coconut milk, are actually not so bad. But I guess that’s all fringe stuff and saturated fats are actually generally bad. ↩︎

I remember even Michael Pollan, in the Omnivore’s Dilemma or something, writing about how most attempts to reduce food to numbers are a waste of time… but actually the omega-6-to-3 ratio is really important, and it matches up well with “we used to eat a lot of leaves and were healthy, now we eat a lot of grains/seeds and are less healthy.” ↩︎

I don’t know why these don’t add up to 49g. Claude says it’s because they’re different measures: first you measure total fats, then you measure each subtype, so it doesn’t guarantee they’ll match. Still, we’re 6g off. This bothers me but not enough to research more. ↩︎

this might be because it’s a Vitamix. I love Vitamix. It does one job well. ↩︎

I set up a NAS and now I'm ill

…matic. ok I’ll stop, sorry

guh! I thought it’d be nice to have my one source of truth for all my data I care about. I can reference it from anywhere, and it’ll back up to The Cloud. Plus, music server.

It was more of a pain than I expected!

buying the right stuff

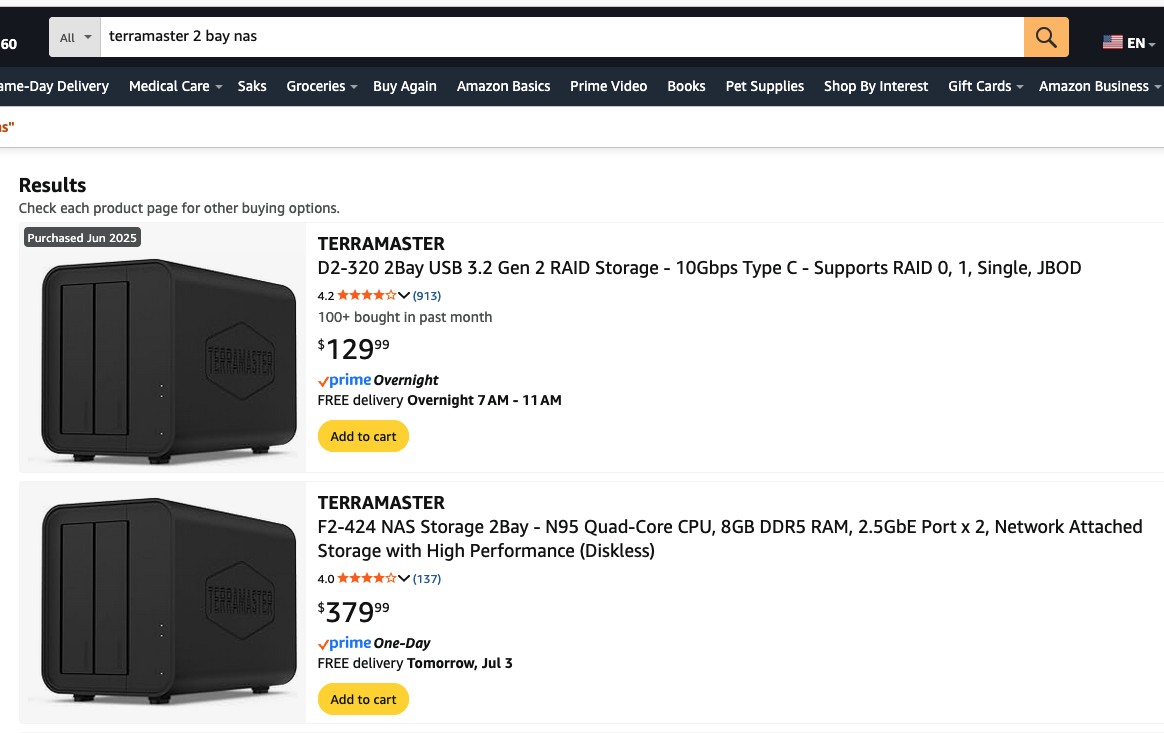

I searched for a NAS and bought one. Well, I thought I did. You’ll have to forgive me for thinking this first result was a NAS, given the search terms and all the rest of the results:

I guess I should have noticed it was very cheap. Alas: it was a hard drive enclosure. Well. Returned it and bought a QNAP TS-216G-US.

Luckily I did the HD just fine: a 1TB Western Digital NAS SSD123.

Got a UPS with AVR while I’m at it, since our @&*$%#! grid means we lose power more often these days.

dive into bizarro software world

I didn’t really think about it, but buying a QNAP NAS is really buying a QNAP El Cheapo Computer running QNAP OS, which means you get more-or-less whatever software they have made available for QNAP OS.

Setting it up is more of a thing than I’d guessed! you connect through guessing its address on your LAN, then you can set up “MyQNAPCloud”? You have to choose all sorts of setup things like do you want a “thin volume”, “thick volume”, or “static volume” on your hard drive? Gah

Then you’re in its knockoff-Windows GUI, f’ing everything has a splash screen Wizard, and you go through their App Center stepping over 19 different Backup/Sync apps, 11 “Entertainment” apps such as “Kazoo Server”, a lil category called “Surveillance”, …

Luckily “HBS Hybrid Backup Sync”, the preinstalled backup app, let me set up the following syncs easily:

- from Google Drive to NAS (real-time)

- from Dropbox to NAS (real-time)

- from NAS to Glacier (nightly)

access my files

On my local network at home, I can go to 192.168.1.76 and find the NAS. I don’t know why it’s .76. I don’t even remember how I found it the first time when I plugged everything in and then went “now what?”

I can get there via myqnapcloud.com. Then that gives me a “smart URL” that’s https://qlink.to/(my nas name). Most importantly, I can access it like a HD, I think, on my local network or once I set up a VPN. More on that later.

(I’m sure there’s some way I can ssh? I hope? geez I didn’t even get this far yet)

jellyfin again

Jellyfin lets you stream your music from anywhere. Plex does too, but they’re getting worse over time and charging Yet Another Subscription, while Jellyfin remains free. Alas, free also sometimes means pain in the ass.

(I originally wanted to buy from Terramaster, the #3 NAS company, because they don’t lock you in to their HDs like Synology, and they advertise Jellyfin built-in. but I figured QNAP, the #2 NAS company, would be just as good, and how hard can installing software be? alas)

Anyway someone made an app you can install for QNAP Janky OS, and it seems to work, hooray

The last bit I can’t figure out is how to get it to serve jellyfin over https or install tailscale. The jellyfin-qnap maker wrote a series of incantations that did not work, though it’s probably my fault, because I did the usual “forget about certificates for 6-12 months, let all knowledge leave my brain, then try to learn about them again.”

ach, vpn

I can skip all this https nonsense if I use a VPN!

- Attempt 1: there is a Tailscale QNAP app! But doesn’t work for my NAS version! Gah.

- Attempt 2: there’s the “QVPN” app which lets you set up an OpenVPN connection. Or a L2TP/IPSec connection. Claude guided me through all these settings, all the ports to open, all the troubleshooting, it didn’t f’ing work.

- Attempt 3: install Tailscale from container. The only setting I had to change (thanks Claude) was to run it in “Network mode: Host.” It worked! As soon as I logged in, the logs gave me a little URL to go to to log in to my tailscale account. Then it’s a machine on tailscale just like any other. Hell yeah. So I can access it when I’m not at home, use Jellyfin without fear of exposing a public http port, and even mount it as a regular hard drive.

Why SSD? I guess I could have bought a 3.5" HDD: cheaper and bigger. But I have small data requirements (200Gb-ish), I still have it in my mind that “SSD is better”, and no spinning disks means slightly quieter I guess. ↩︎

why only 1TB? much like house storage, the amount of junk you have scales with your available space ↩︎

why not 2 drives set up as RAID? I guess I like the idea of 2 backups: one local exact copy for when the HD dies, and one on AWS in case our house burns down. but this feels maybe a bit paranoid: the odds that Amazon dies the same time my HD does seem very low. IF I do test my backup and recovery. Which I will. Of course. ↩︎

The Part That Has Cancer

When you suffer, do you linger on it, or shrug and move on?

Linger:

- you have to process your feelings. if you think you’re not lingering, maybe you’re going to feel the same thing, just spread out over time

- take steps to make sure you don’t suffer next time

- The Body Keeps The Score

Shrug:

- sometimes there’s no feelings to process!

- you start feeling sorry for yourself

- are you inventing trauma when there could just not be any there?

- that study where people who play Tetris immediately after a traumatic event have less lasting trauma

| You should linger | You should shrug | |

|---|---|---|

| You linger | Feelings processed | Invented trauma |

| You shrug | Trauma lasts forever | No problem 🤙 |

how do you know

argh how do you know

obviously this is a feeling question, not a thinking question. it’s only correlated with the objective thing that happened; two people can both be in an earthquake but only one has lasting trauma. depression goes down in wartime. clearly not only “what happened” but also “how does it feel” and “what does it mean to you” all matter. is the answer just “you have to learn this over time”? oof

why is this important

typing happily at my computer on a pleasant day, I can’t really tell you. but when I’m suffering, I absolutely can. it means the world to have someone (perhaps myself) helping me through it. sometimes that’s consoling me, commiserating, talking, even (maybe primarily) just being there.

there are a million slings and arrows every day. you’ve got to learn to shrug. maybe the “everyone’s in therapy, everyone’s on SSRIs, everyone’s still depressed” modern world is partially a result of inability to shrug.

but also: 1/3 of us are going to get cancer. you love your spouse? it’s more than half, 5/9 that one of you will. you have two kids you love: 80% chance one of you will.

maybe it’s not that bad; maybe that includes the “easily cut it off and you’re done” minor skin cancers, I don’t know. but maybe it’s worse: lump in every other disease that’s “as bad as cancer.” good chance you undergo significant suffering in your life. if nothing else, when you die: maybe a lucky few of us get the “hit by a meteor” death where one second you’re there and the next you’re gone, but most of us will have a hard time of it. and when you’re there, you hope your loved ones, and especially you, have learned to linger.

- Code for People is Organization

- DJ and Cooks' Knowledge Data Structures

- So What About Twitter

- What a Weird Underworld

- Pokemonization

- 2 Focus 2 Positive

- Micro-frustration

- Some Claims About Our Present World

- Spending

- Parenting Snapshot

- Noticing What's Good

- Bragging Over Fairness

2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010